social security tax definition

You can get this form at any Social Security office or by calling 800 772-1213. Unemployment insurance benefits and supplements accident injury and sickness benefits old-age disability and survivors pensions family allowances reimbursements for medical and hospital expenses or provision.

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

Code on Social Security 2020 was introduced in Lok Sabha on 19th September 2020 vide Bill No.

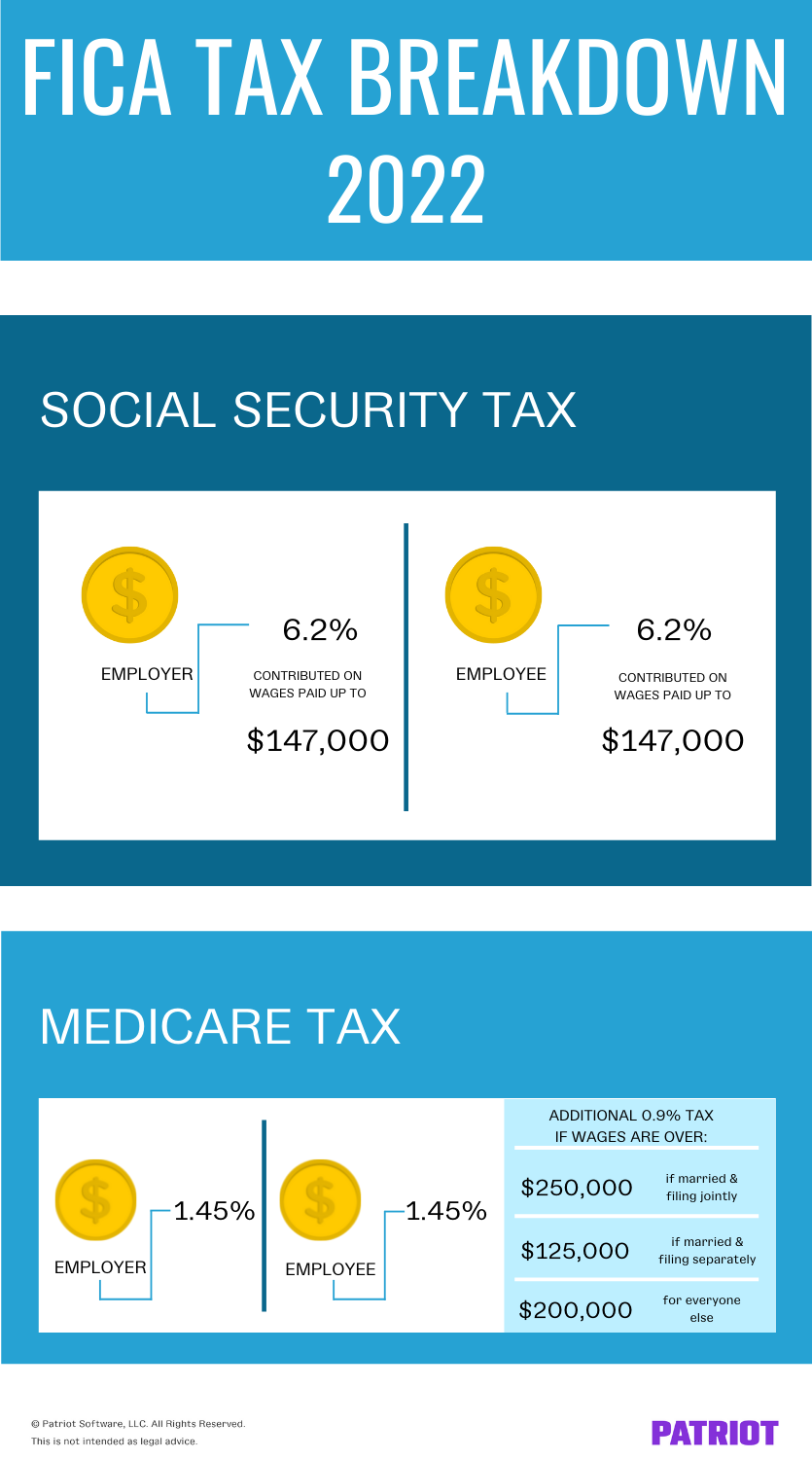

. In addition to the employees tax your employer is also required to pay 62 of your gross income into the system. Instructions for Form 8959 and Questions and Answers for the Additional Medicare Tax. Social Security benefits are paid out monthly to retired workers and their spouses who have during their working years paid into the Social Security system.

Social Security benefits are also. These are called social risks and include retirement sickness disability old age survivor death of earning members maternity unemployment etc. Tax Professionals Adding Social Security advisory services transforms a seasonal tax practice with a year round client opportunity.

The wage base limit is the maximum wage thats subject to the tax for that year. To establish a Social. A portion of Social Security retirement disability and other benefits are subject to federal income tax if your overall income exceeds a cap the US.

You can use your account to request a replacement Social Security card check the status of an application estimate future benefits or manage the benefits you already receive. Social Security makes allowances for people to receive benefits quickly if they suffer from medical conditions that are so obvious that they easily meet disability standards. How much you owe in Social Security taxes is based on your net income when you are self-employed.

The standard OASDI tax rate for withholdings for employees is 62 So you will see 62 of each paycheck withheld for Social Security tax. Additional Medicare Tax Withholding Rate. To pay self-employment tax you must have a Social Security number SSN or an individual taxpayer identification number ITIN.

Create your personal my Social Security account today. If you never had an SSN apply for one using Form SS-5 Application for a Social Security Card. Note that this amount is entirely separate from the amount of income tax that you will owe to the IRS.

For the past couple of decades however FICA tax rates have remained consistent. Social security means the efforts related to protect and support the sufferers against the impacts of different types of unwanted activities due to that the life of persons is under risk. Social Security tax rates remained under 3 for employees and employers until the end of 1959.

Only the social security tax has a wage base limit. Social security contributions are compulsory payments paid to general government that confer entitlement to receive a contingent future social benefit. Compassionate Allowances quickly identify diseases and medical conditions that fall under the Blue Book of Impairments with minimal medical information.

Code on Social Security 2020 is expected to to amend and consolidate the laws relating to social security with the goal to. A free and secure my Social Security account provides personalized tools for everyone whether you receive benefits or not. Obtaining a Social Security Number.

AN ACT to provide for the general welfare by establishing a system of Federal old-age benefits and by enabling the several States to make more adequate provision for aged persons blind persons dependent and crippled children maternal and child welfare public health and the administration of their unemployment compensation laws. Medicare tax rates rose from 035 in 1966 when they were first implemented to 135 in 1985. The Social Security tax cap rate for 2022 is 147000.

If your income under this definition isnt above the 25000 or 32000 limits your Social Security benefits are yours to keep tax-free. For earnings in 2022 this base is 147000. 121 of 2020 to withdraw the pending Code on Social Security 2019 and to propose a fresh Bill namely the Code on Social Security 2020.

As a Registered Social Security Analyst the final billable product you provide your client is a written custom analytical report. Employers and employees split the tax. Twelve states also tax some or all of their residents Social Security benefits.

Colorado Connecticut Kansas Minnesota Missouri Montana Nebraska New Mexico Rhode Island Utah Vermont and West.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Social Security Congressman Tim Walberg

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

/GettyImages-157422696-91d9faa2445f43fd95062873356b57bc.jpg)

8 Types Of Americans Who Aren T Eligible To Get Social Security

What Is Social Security Tax Calculations Reporting More

What Are Social Security Benefits Social Security Faq What S Social Security

Understanding Your W 2 Controller S Office

What Are Payroll Taxes And Who Pays Them Tax Foundation

What Is Social Security Tax Calculations Reporting More

/heroexportjourney-4229705-df42b41ba8f7483fba08a542a4eae4ac.jpg)

Social Security Tax Definition

Disability Determination Services Colorado Department Of Human Services

/GettyImages-172770509-b6197b1c0b664655a1c9689c22024852-bca1bcbcd0e3458f87bbe700444c5a21.jpg)

The Purpose Of Having A Social Security Number

Ask Larry Will The 2022 Cola Apply To Benefit Rates For People Born In 1960

Tax Dictionary Form Ssa 1099 Social Security Benefit Statement H R Block

Disability Benefits And Hd Huntington S Disease Society Of America

How Does Social Security Work The Motley Fool

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)